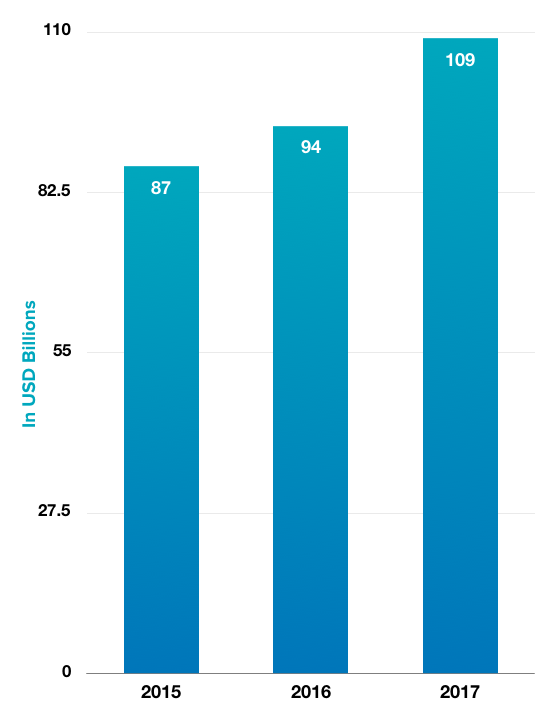

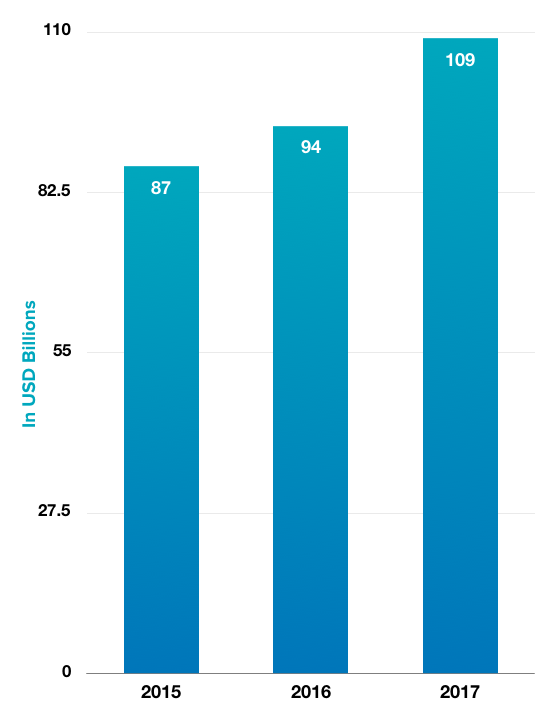

Capital Admitted

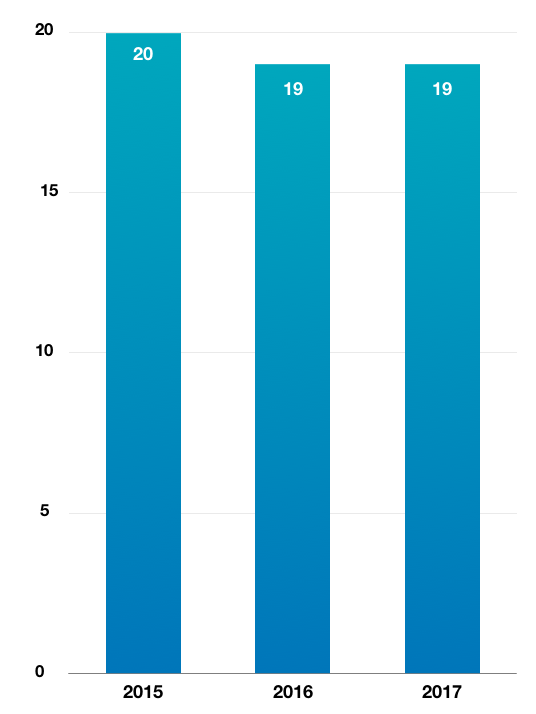

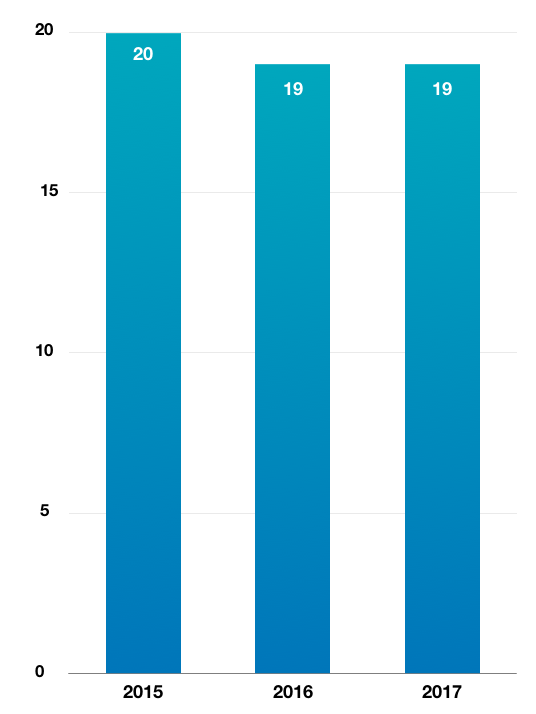

No. Of Listings

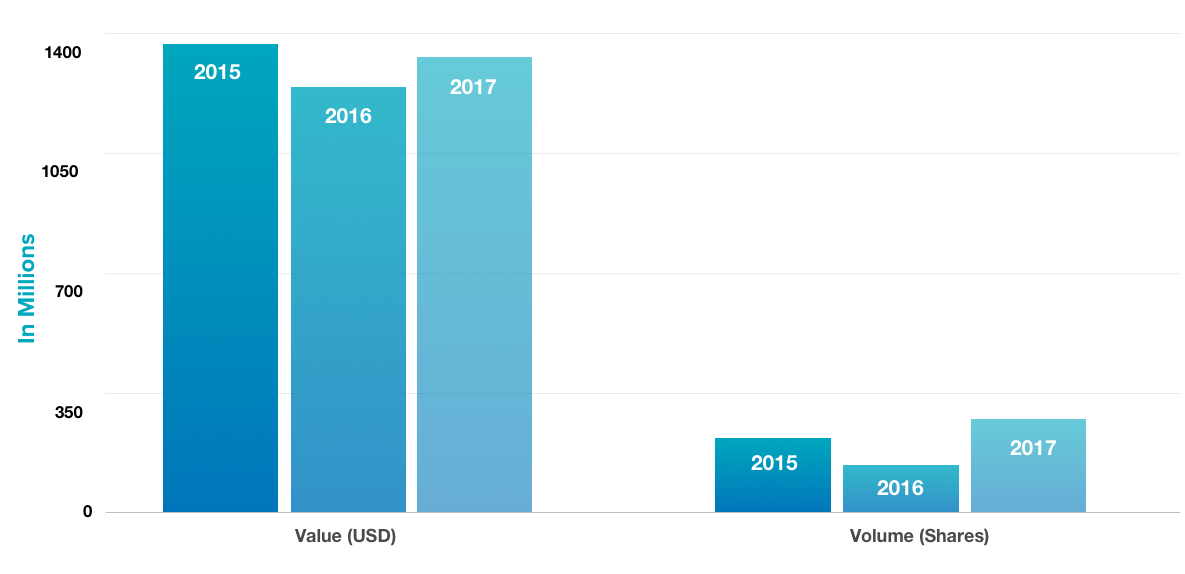

| Value (USD) | Volume (shares) | No. of trades | |

|---|---|---|---|

| 2017 | 1.331 billion | 273 million | 29,518 |

| 2016 | 1.243 billion | 138 million | 22,913 |

| 2015 | 1.368 billion | 219 million | 30,637 |

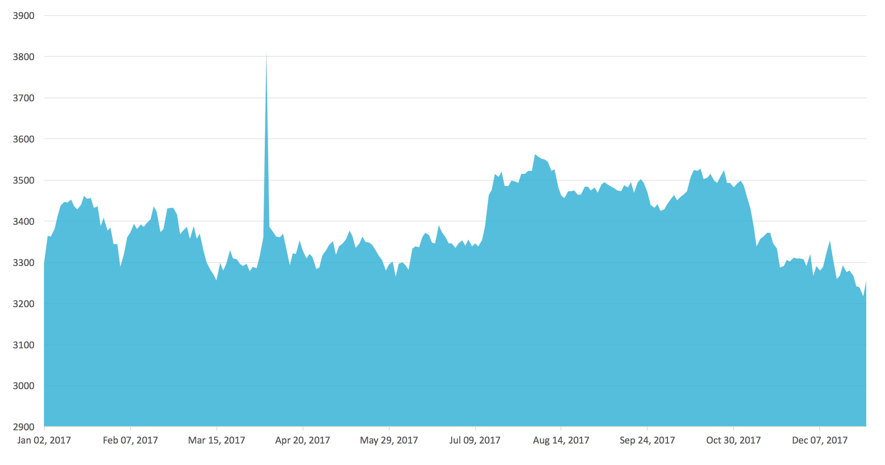

The index edged down 0.1% over the year, from 3,294 at the end of 2016 to 3,289 at the end of 2017. It tracks 20 liquid stocks listed on Dubai Financial Market, the Abu Dhabi Securities Exchange and Nasdaq Dubai.

Most active 10 members by % traded value

| Member | % Traded Value |

|---|---|

| EFG-Hermes Brokerage | 55.33 |

| Arqaam Securities | 16.06 |

| Al Safwa Mubasher | 11.81 |

| Emirates NBD Securities | 3.78 |

| Mashreq Securities | 2.18 |

| Al Ramz Capital | 2.10 |

| Menacorp | 1.69 |

| Deutsche Bank | 1.29 |

| NBAD Securities | 1.14 |

| SHUAA Capital | 0.76 |

Most active 4 members by % traded value (excluding market maker)

| Member | % Traded Value |

|---|---|

| Menacorp | 62% |

| Integrated Securities | 14% |

| Al Ramz Capital | 12% |

| Al Safwa Mubasher | 10% |

| Issuer | Month | Value (USD) |

|---|---|---|

| Investment Corporation of Dubai | February | 1 billion |

| Dubai Islamic Bank | February | 1 billion |

| Government of Hong Kong | March | 1 billion |

| Warba Bank | March | 250 million |

| Government of Indonesia | March | 1 billion |

| Government of Indonesia | March | 2 billion |

| Islamic Development Bank | April | 1.25 billion |

| Dar Al Arkan | April | 500 million |

| DAMAC | April | 500 million |

| Islamic Development Bank | September | 1.25 billion |

| APICORP | November | 500 million |

| Total | 10.25 billion |

| Issuer | Month | Value (USD) |

|---|---|---|

| Industrial and Commercial Bank of China | May | 561 million |

| Industrial and Commercial Bank of China | May | 400 million |

| Industrial and Commercial Bank of China | May | 300 million |

| China Construction Bank | June | 1.2 billion |

| Investment Corporation of Dubai | October | 200 million |

| Yinchuan Tonglian | October | 300 million |

| Emirates NBD | November | 750 million |

ABDUL WAHED AL FAHIM

Chairman, Nasdaq Dubai

As well as expanding its markets in 2017, Nasdaq Dubai focused on strengthening many important relationships that will underpin its growth for years to come. Some of these connections are domestic, some international. All of them position the exchange to accelerate its mission to transform the capital markets landscape and promote prosperity, by offering investors effective tools for increasing wealth. Within the UAE, the signing of our licence agreements with Dubai Financial Market (DFM) and Abu Dhabi Securities Exchange (ADX), which enable Nasdaq Dubai to offer futures on their equity indices, are an inspiring example of successful cooperation between different national entities. Nasdaq Dubai also signed an MoU with Dubai Land Department to streamline land-related capital markets transactions.

Internationally, an agreement reached with New York-based MSCI for futures on its GCC indices is highly significant, as is the increase in bond listings from China, which as the UAE’s largest trading partner is rapidly growing in importance to our nation’s future. Our Murabaha Islamic financing platform facilitated the first Sukuk issuance by the multilateral Africa Finance Corporation. We look forward to renewed growth in 2018 building on these and many other fruitful relationships with our UAE and international partners.

by

HAMED ALI

Chief Executive Officer, Nasdaq Dubai

A key strategy of Nasdaq Dubai throughout 2017 was to develop and broaden our equity derivatives platform, following its successful launch in September 2016. We added more products, more brokers and a new market maker, while trading activity reached a total of AED 460 million over the year. Above all, we focused on expanding awareness of the market, as equity derivatives platforms in every part of the world typically take several years to achieve their full potential, and our own region will be no exception. Our programme of seminars and workshops for brokers was extremely well attended, reflecting their appetite for the new instruments, and we have encouraged the brokers’ own outreach to their customers to explain the valuable hedging, investment and leverage advantages that futures offer. With index futures in the pipeline for early 2018, the market is set for further growth.

Our other markets also developed strongly during 2017. The IPO of ENBD REIT confirmed the exchange’s leadership in the UAE in listing this young asset class. Total equities trading rose 7% on Nasdaq Dubai in a year when activity fell on many other regional exchanges. Another strong year for Sukuk and bond listings, at 10.25 billion US dollars and 3.71 billion US dollars respectively, maintained our expansion in the debt sector, with a diverse mix of issuers across many industry sectors and from countries around the world. Our Murabaha platform continued to develop, including welcoming its first conventional bank as a member. Nasdaq Dubai Academy again fulfilled its training mandate for hundreds of finance professionals across multiple capital markets topics.

Amid active trading, Nasdaq Dubai increased the number of UAE companies on which single stock futures are offered from nine at the beginning of 2017 to 16 by year end. The new additions were National Bank of Abu Dhabi (NBAD), Dubai Financial Market (DFM) and Dubai Investments (DIC) in April, followed by DAMAC Properties in May, Emaar Development in November, and then ADNOC Distribution and Emaar Malls in December. The contracts on Emaar Development and ADNOC were launched on the same day that those two companies listed their shares following their IPOs, giving investors the opportunity to hedge or take an investment position from the outset.

The European Securities and Markets Authority (ESMA) opened the door in March to further growth in Nasdaq Dubai’s futures market, by granting recognition to the exchange’s clearing infrastructure. The ruling enables banks based in the EU to become Clearing Members on the exchange, which paves the way for increased participation by overseas banks and investors.

In October, Nasdaq Dubai announced agreements with MSCI, DFM and ADX under which the exchange will create futures on their equity indices. Launch dates will be announced soon. These index derivatives will be a first in the region and will attract further international and regional participation in Dubai’s capital markets. Equity indices are suitable in particular for large investors who wish to take a view on a whole market, rather than single stocks.

Robert Ansari, Head of MSCI for the Middle East, said: “The UAE equities market is one of the most important and vibrant in the Middle East and we are delighted to deepen our involvement with it as well as the markets of other regional countries. As the region’s international exchange with global investor links, Nasdaq Dubai is the ideal partner for this project through our licence agreement.

NAEEM Shares & Bonds joined the futures market as a Member in January, bringing the total number of Members to eight. Al Ramz Capital joined as a market maker in February, becoming the second active liquidity provider.

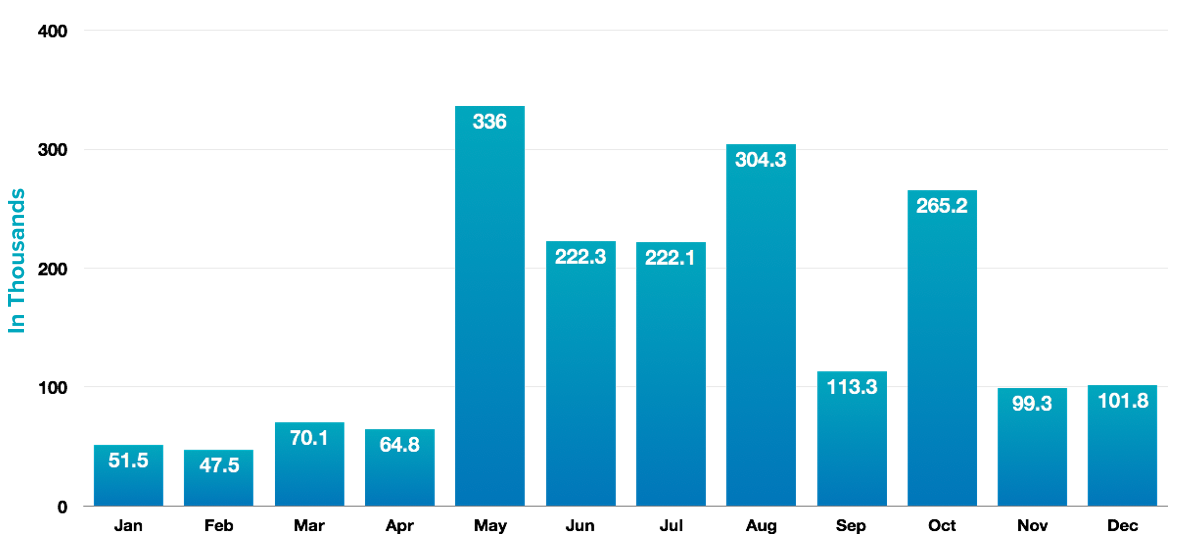

Futures traded value in 2017 reached AED 464 million from 2.5 million contracts, amounting to significant activity in the first full year of a new market. The most heavily traded contracts were in Emaar Properties followed by Union Properties and then DAMAC Properties. The most active brokers during the year (excluding market makers) were Menacorp with a 62% market share, followed by Integrated Securities with 14%, Al Ramz Capital with 12% and Al Safwa Mubasher with 10%. SHUAA Capital was the most active market maker with a 91% share of market-making by value, followed by Al Ramz Capital with 9%.

The IPOof ENBD REIT in March, raising 105 million US dollars, underlined Nasdaq Dubai’s leadership in expanding the opportunities for investors in the UAE‘s capital markets. Real Estate Investment Trusts (REITs) are a young asset class in the country and we are the only exchange that lists them. ENBD REIT, managed by Emirates NBD Asset Management and based in the DIFC, is Sharia’a-compliant and invests in commercial and residential property as well as buildings in other sectors such as healthcare and education.

Tariq Bin Hendi, Director of ENBD REIT, said: "Our IPO on Nasdaq Dubai has been a great success and we are grateful to all parties involved in the process. Our rationale for the listing was to improve liquidity and allow greater flexibility in managing the REIT."

The IPO was facilitated by a Memorandum of Understanding signed in February by Nasdaq Dubai and the Dubai Land Department, aimed at streamlining land-related financial activities in the UAE.

As part of its ongoing engagement with UAE and overseas companies that are considering raising capital through a listing, Nasdaq Dubai held a workshop in March with Jebel Ali Free Zone (Jafza), to explain the benefits and processes of an IPO to Jafza-based companies. The seminar followed Jafza’s announcement of new regulations in January that enable companies there to carry out a stock exchange listing.

While total equities traded value on the UAE’s three financial exchanges declined slightly in 2017, Nasdaq Dubai achieved an increase of 7% to 1.33 billion US dollars, up from 1.24 billion US dollars in 2016. Volume rose 98% to 273 million shares, up from 138 million. The most heavily traded stock on the exchange was DP World, Dubai’s largest company by market capitalisation, which reached its 10th listing anniversary in November. Al Ramz Capital became the fourth equities market maker on Nasdaq Dubai in February, and the following month SICO UAE and Daman Securities joined the exchange as the 33rd and 34th equities Members. The most active broker on the exchange by equities traded value in 2017 was EFG-Hermes, followed by Al Safwa Mubasher and Arqaam Securities.

The FTSE Nasdaq Dubai UAE 20 index, which tracks 20 liquid stocks listed on Nasdaq Dubai, DFM and ADX, ended the year at 3,289, down 0.1% from 3,294 at the end of 2016.

Nasdaq Dubai listed 11 Sukuk with a total nominal value of 10.25 billion US dollars in 2017, maintaining its position as one of the most active exchanges in the world for new Sukuk listings. Total current listed value on Nasdaq Dubai rose above 50 billion US dollars for the first time on any exchange, reaching 50.8 billion US dollars by year-end, up from 43.9 billion US dollars at the end of 2016.

Overseas issuers dominated during 2017, while UAE issuers were also well represented. Issuers ranged from governments and multilateral organisations to banks and property companies. Nasdaq Dubai’s continuing appeal as a listing venue reflects our commitment to streamlined and flexible listing processes to meet the needs of issuers and their investors.

The first Sukuk listing of the year was a one billion US dollar issuance in February by Investment Corporation of Dubai. This was the second Sukuk listing on the exchange from the principal investment arm of the Government of Dubai, following a 700 million US dollar listing in 2014. Also in February Dubai Islamic Bank listed a one billion dollar issuance in their fifth Sukuk listing since 2013, bringing the bank’s total listed value to 4.25 billion US dollars.

In March the exchange welcomed the listing of a 1 billion US dollar Sukuk issued by the government of Hong Kong, following its two listings of 1 billion US dollars each in 2014 and 2015. The same month Warba Bank of Kuwait carried out its first listing on Nasdaq Dubai with a 250 million US dollar instrument. Also in March the Indonesian government brought two Sukuk to the exchange valued at 1 billion US dollars and 2 billion US dollars, making it the largest Sukuk issuer on Nasdaq Dubai by value with a total of 11.5 billion US dollars from eight listings.

In April, Islamic Development Bank (IDB) listed its eighth Sukuk on the exchange, a 1.25 billion US dollar instrument that raised its total listed value to 9.8 billion US dollars. Saudi Arabia construction company Dar Al Arkan listed a 500 million US dollar Sukuk in April, followed by UAE property company DAMAC Properties with a listing of the same size later that month.

IDB returned to the exchange in September with another listing of 1.25 billion US dollars, while in November APICORP, the oil and gas development bank, listed a 500 million US dollar Sukuk, following its first listing of the same size in 2016.

Nasdaq Dubai stepped up its policy of facilitating the growth of the Sukuk sector internationally during the year. In May we became founding members of a task force set up in Tunis together with the Tunisian government and Bourse de Tunis, with a remit to pave the way for the country’s first ever Sukuk issuance. In November we signed a Memorandum of Understanding with the Nairobi Securities Exchange to support the creation of a Sukuk sector in Kenya.

An active year for conventional bond listings was dominated by Chinese issuers, beginning with Industrial and Commercial Bank of China (ICBC) listing a 500 million euro (561 million US dollars) bond in May together with two bonds of 400 million US dollars and 300 million US dollars respectively. Ranked the world’s largest bank by market capitalisation in 2016, ICBC had earlier listed bonds of 500 million US dollars and 400 million US dollars in 2015 and 2016 respectively. In June 2017 China Construction Bank listed a 1.2 billion US dollar bond, its second on the exchange following its 600 million US dollar listing the previous year. Investment Corporation of Dubai listed a 200 million US dollar bond in October, adding to its 300 million US dollar bond listed on the exchange in 2014. The same month Yinchuan Tonglian Capital Investment Operation Company became the first Chinese entity from outside the banking sector to list a bond on Nasdaq Dubai with a 300 million US dollar issuance. The company is based in Yinchuan, capital of the Ningxia Hui Autonomous Region, which hosts the annual China-Arab States Expo trade exhibition and has a substantial Muslim population.

Emirates NBD listed a 750 million US dollar bond in November. The bank is the largest issuer by value of conventional bonds on Nasdaq Dubai, with a total of 5.03 billion US dollars from eight listings.

Many of the Sukuk and bond listings during the year were marked by bell ceremonies at which senior representatives of issuers opened Nasdaq Dubai’s market. Regular attendees included His Excellency Essa Kazim, Governor of Dubai International Financial Centre (DIFC), Secretary General of Dubai Islamic Economy Development Centre (DIEDC), Chairman of Borse Dubai and Dubai Financial Market (DFM) and a Board Director of Nasdaq Dubai, as well as our Chairman Abdul Wahed Al Fahim together with senior executives from Nasdaq Dubai, DFM and DIEDC.

Nasdaq Dubai’s Murabaha Platform for Islamic financing maintained its expansion in 2017. The multilateral Africa Finance Corporation made its first use of the platform in February to facilitate the issuance of a 150 million US dollar Sukuk. In November, National Bank of Fujairah became the first conventional bank to join since the platform was launched in 2014, for use by its Sharia’a-compliant window NBF Islamic.

Total Murabaha transactions on Nasdaq Dubai increased by 18% in 2017 to 28.4 billion US dollars, up from 24.0 billion US dollars in 2016. The platform is used by banks and other financial institutions on behalf of individual as well as corporate clients. Established through a joint initiative with Emirates Islamic in 2014, the platform’s success reflects its substantial advantages over traditional Murabaha channels, utilising Sharia’a-compliant Certificates that are traded in Nasdaq Dubai’s Central Securities Depository (CSD). As well as providing Sharia’a certainty, the transactions can take place in minutes and are executed at a fixed price with no spread.

Nasdaq Dubai Academy delivered 21 training courses during the year, providing expert instruction in financial markets topics to more than 350 individuals, including employees of more than 30 companies. Equity futures training for brokers was a key topic, including workshops on index trading held in conjunction with DFM and ADX. The Academy also ran a simulated futures trading game in which more than 140 brokers from 12 brokerages took part.

Other training topics ranged from Essentials of Capital Markets, Central Counterparty and AML, Structuring Sukuk and Islamic Asset Management Products, to training for CISI’s Islamic Finance Qualification (IFQ) and International Certificate in Wealth and Investment Management (ICWIM) exam. Customised courses were provided to brokers about REITs. The Academy certified 12 individual brokers from 6 Member firms as Trading Managers able to trade on the exchange.

Our relocation to brand new and larger premises in 2018, in the DIFC’s The Exchange Building (Gate Village 11), heralds the next phase of growth for Nasdaq Dubai. We look forward to welcoming our existing and future business partners there, and in particular to our MarketSite, an events and TV space that we will develop into the region’s centre for capital markets thought leadership and media activity.

This section provides an overview of Nasdaq Dubai’s governance during the year 2017. It explains how the Company applies principles of sound corporate governance to ensure an environment of strategic direction, performance, accountability and control in the business.

At the foundation of a well governed company is an effective Board that provides good leadership and oversight, within a framework of prudent and effective controls that enable risk to be assessed and managed.

The Nasdaq Dubai Board is committed to the highest standards of corporate governance and business integrity. The Board continues to ensure that we adhere to good governance principles and practices.

The Nasdaq Dubai Board represents and acts on behalf of its shareholders, Dubai Financial Market and Borse Dubai, and is committed to strong corporate governance policies, practices and procedures designed to make the Board more effective in exercising its oversight role for achieving the Company’s strategic objectives and for the stewardship of the Company’s resources. The Board adopts the view that corporate governance should promote good performance and integrity as well as conformance with legislation and that effective governance practices enhance the Company’s ability to achieve its strategy and long-term success.

While the Board does not have responsibility for day to day management of the company, it stays informed about the company’s business and provides guidance to company management through periodic meetings and other interactions. In accordance with good governance practice, the roles of Chairman and Chief Executive are distinct and separate with a clear division of responsibilities. This separation of roles promotes more effective communication channels for the Board to express its views on Management. The Chairman presides over meetings and is responsible for the running and leadership of the Board and ensuring its effectiveness. The Chief Executive has delegated authority from and is responsible to the Board for managing the Company’s business. We believe that this separation of roles and allocation of distinct responsibilities to each role facilitates communication between senior management and the full Board about issues such as corporate governance, succession planning, executive compensation and company performance.

The Board has adopted a formal schedule of matters specifically reserved for its decision-making, which includes the annual budget, strategy and long term business objectives, major projects and contracts and significant capital expenditure. The Board has created three Committees to ensure effective and efficient Board operations in accordance with their respective Charters.

During the financial year, the Board met on 4 occasions in person in Dubai. The Board has continued to oversee the Group’s strategy, risk framework and financial performance. The Board uses Nasdaq’s online board portal, Directors Desk for its meetings, which makes make the board process efficient and has the benefit of considerable savings in resources, paper and printing.

The Nasdaq Dubai Board comprises 7 Non-Executive Directors including the Chairman, Abdul Wahed Al Fahim. Biographical details of the Directors and the Committees on which they serve are set out below. The biographies demonstrate a wide range of experience and skills, including leadership and knowledge of corporate governance requirements and practices, enabling the Board members to discharge their responsibilities and to bring independent judgment on matters of strategy, performance and standards of conduct which are important to the success of the exchange.