Capital Admitted

No. Of Listings

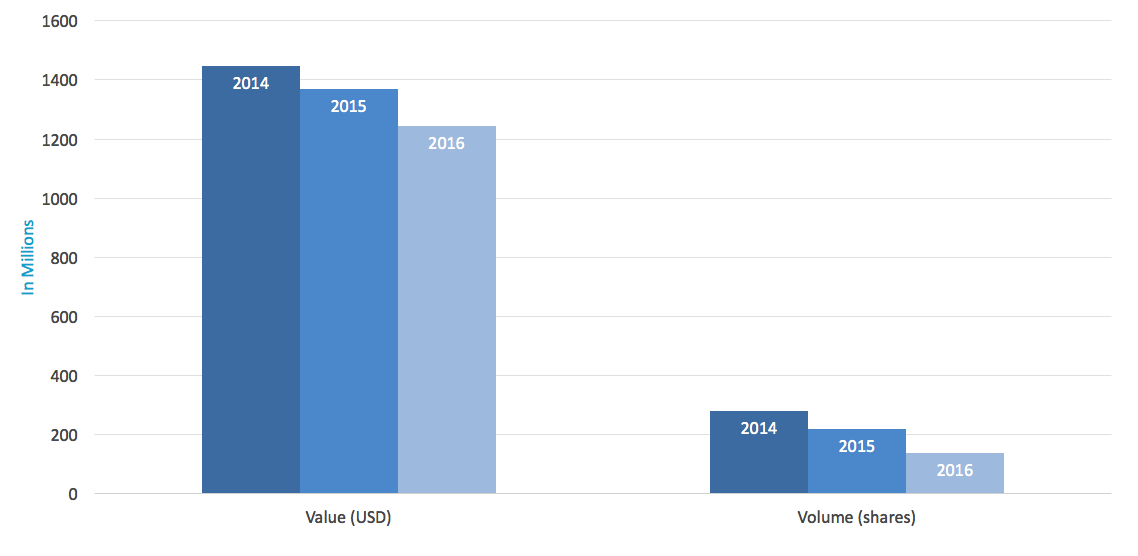

| Value (USD) | Volume (shares) | No. of trades | |

|---|---|---|---|

| 2016 | 1.243 billion | 138 million | 22,913 |

| 2015 | 1.368 billion | 219 million | 30,637 |

| 2014 | 1.447 billion | 280 million | 24,698 |

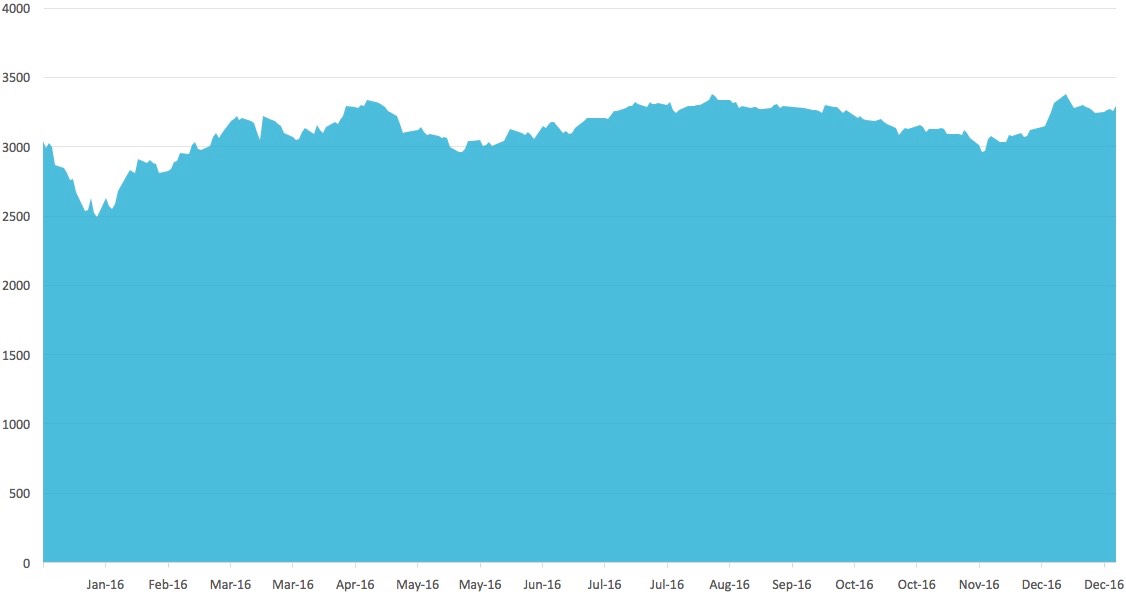

The index rose 7.0% over the year, from 3,063 at the end of 2015 to 3,294 at the end of 2016. It tracks 20 liquid stocks listed on DFM, the Abu Dhabi Securities Exchange and Nasdaq Dubai.

Most active 10 members by % traded value

| Member | % Traded Value |

|---|---|

| EFG-Hermes Brokerage | 61.38 |

| Mubasher | 15.43 |

| Arqaam Securities | 10.95 |

| Menacorp | 2.57 |

| Emirates NBD Securities | 2.51 |

| Deutsche Bank | 2.01 |

| Al Ramz Capital | 1.54 |

| NBAD Securities | 0.85 |

| SHUAA Capital | 0.77 |

| ADCB Securities | 0.7 |

Most active 3 members by % traded value (excluding market maker)

| Member | % Traded Value |

|---|---|

| Menacorp | 61% |

| Al Ramz Capital | 30% |

| Al Safwa Mubasher | 9% |

| Issuer | Month | Value (USD) |

|---|---|---|

| APICORP | January | 500 million |

| Government of Sharjah | January | 500 million |

| Islamic Development Bank | March | 1.5 billion |

| Government of Indonesia | March | 1.75 billion |

| Government of Indonesia | March | 750 million |

| Dubai Islamic Bank | March | 500 million |

| Islamic Corporation for Development of Private Sector | April | 300 million |

| Boubyan Bank | May | 250 million |

| Emirates Islamic | June | 750 million |

| DP World | June | 1.2 billion |

| Noor Bank | June | 500 million |

| Emirates Islamic | September | 250 million |

| Sharjah Islamic Bank | September | 500 million |

| Emaar Properties | September | 750 million |

| Ahli United | October | 200 million |

| Islamic Development Bank | December | 1.25 billion |

| Total | 11.45 billion |

| Issuer | Month | Value (USD) |

|---|---|---|

| Industrial and Commercial Bank of China | June | 400 million |

| Majid Al Futtaim | July | 300 million |

| China Construction Bank | October | 600 million |

| Total | 1.3 billion |

ABDUL WAHED AL FAHIM

Chairman, Nasdaq Dubai

Dubai’s traditional leadership in developing the region’s capital markets showed fresh vigour in 2016. The successful opening of Nasdaq Dubai’s equity futures market was a milestone that has transformed the investment landscape by offering investors new tools for increasing and preserving wealth. Even more significant than the launch of the market itself is the mindset that lies behind it. Nasdaq Dubai thinks long term, is committed to introducing new investment architecture that benefits issuers and investors across its region and globally and does not shy away from the challenges that come with being a pioneer. We aim not merely to succeed in the existing marketplace but to create a new marketplace that is more sophisticated and larger, with greater variety and more customers.

Nasdaq Dubai will carry this commitment into 2017 and beyond in its equities, derivatives, sukuk and bond markets as well as others. We look forward to bringing new developments to the region’s financial markets that will make a lasting contribution to growth and prosperity.

by

HAMED ALI

Chief Executive Officer, Nasdaq Dubai

With strong support from many of the UAE’s leading brokerages, Nasdaq Dubai opened a futures market on the shares of prominent UAE-listed companies on September 1. This seminal event followed many months and indeed years of planning. It was rewarded by rapid growth in the market as soon as it launched, as investors took advantage of the new opportunities it gave them. Such a warm reception was a welcome validation of the detailed research and analysis that Nasdaq Dubai conducted before setting up the market, which showed enormous demand for such products that was not being met by any other exchange.

We were active on many other fronts as well during the year. A notable achievement was the continued growth of our Sukuk market, which consolidated its stature as the world’s largest by listed value. Of the 16 Sukuk that we attracted during 2016, eight were from UAE issuers and 8 came from overseas, demonstrating our appeal as a truly global market that is also rooted in our own region. Two of our three conventional bond listings during the year came from leading Chinese banks, strengthening an important relationship with a nation that we expect to playing a growing role in the future growth of the exchange.

Our equities market showed impressive resilience over the year, with traded value similar to 2015 in a volatile international climate. Steps taken to ease access to our equities platform for both issuers and investors from Egypt have laid the groundwork for fruitful activity in coming years, as has an agreement signed with the Amman Stock Exchange to look at possibilities for dual listings from Jordan. Our Murabaha platform, a unique Islamic financing platform that we launched in 2014, continued to grow quickly during the year.

The market opened in September with 1-month, 2-month and 3-month futures on the shares of seven companies that are listed on Nasdaq Dubai, Dubai Financial Market (DFM) or Abu Dhabi Securities Exchange (ADX): Aldar Properties, Arabtec Holding, DP World, Dubai Islamic Bank, DXB Entertainments, Emaar Properties, and Etisalat. These are among the best known and most heavily traded companies in the UAE. In October we added Abu Dhabi Commercial Bank and Union Properties to the market, further expanding its appeal to investors. The futures launch partners were SHUAA Capital, Al Ramz Capital, Arqaam Capital, EFG Hermes, Integrated Securities, Mena Corp Financial Services and Mubasher Financial Services.

SHUAA Capital provided market making services as soon as the market launched, supplying a crucial element of the platform’s infrastructure. The other partners were instrumental in connecting a wide range of investors to the new market.

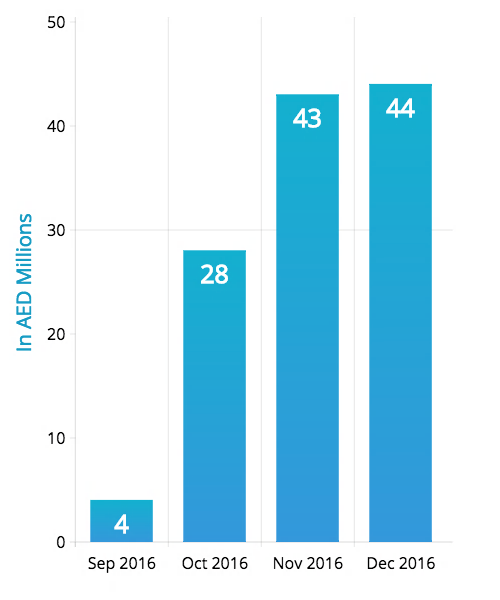

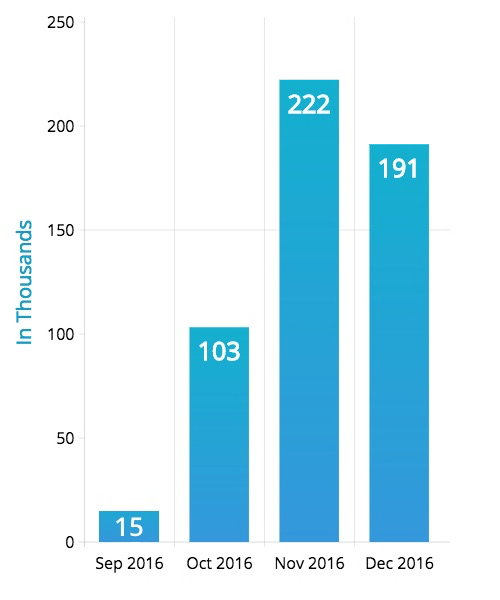

Trading began at once and built up steadily. After reaching AED 4 million in September, traded value reached AED 28 million in October before growing to AED 43 million in November and AED 44 million in December. Traded contracts, each representing 100 shares, expanded from 15,000 in September to 103,000 in October and 222,000 in November followed by 191,000 in December. The most active brokers during the four-month period were Menacorp, with a 61% market share, followed by Al Ramz Capital with 30% and Mubasher with 9%. At the end of the year National Bank of Abu Dhabi was preparing to start market making on the futures market, adding further depth for the benefit of investors.

The benefits of the futures market include hedging existing share portfolios, as well as enabling investors to make gains when share prices are falling as well as rising. These tools were not available before and have brought a new dimension to the UAE’s capital markets that should prove attractive to both existing and new investors. The possibilities of maximized gains through leverage are another significant feature.

The rapid growth of the futures market owes much to a campaign of education and awareness conducted by the exchange, through Nasdaq Dubai Academy, and the brokerages who are taking part in the market. Initiatives included workshops for brokers and investors, as well as an equity and futures trading game played by students that attracted more than 2,300 participants from 26 educational institutions. Nasdaq Dubai will expand such initiatives in tandem with its plans to further develop the market itself by adding futures on more UAE and MENA-listed companies, as well as equity index futures and options.

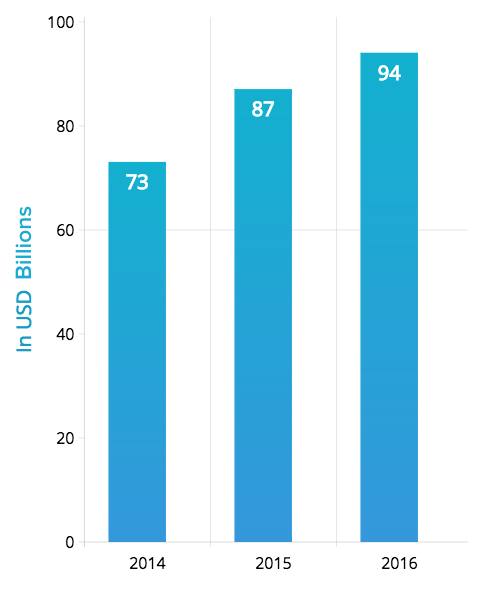

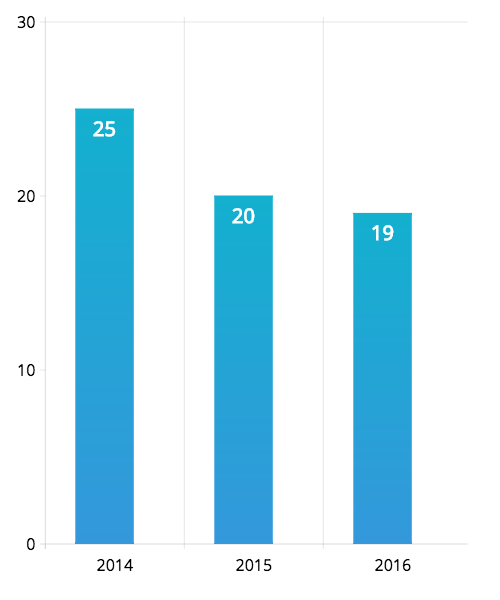

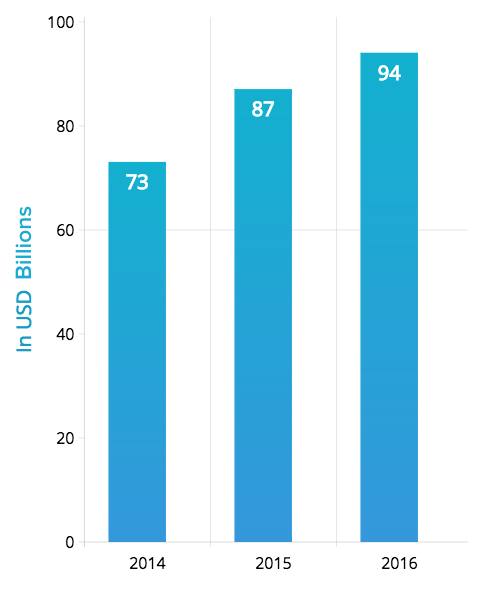

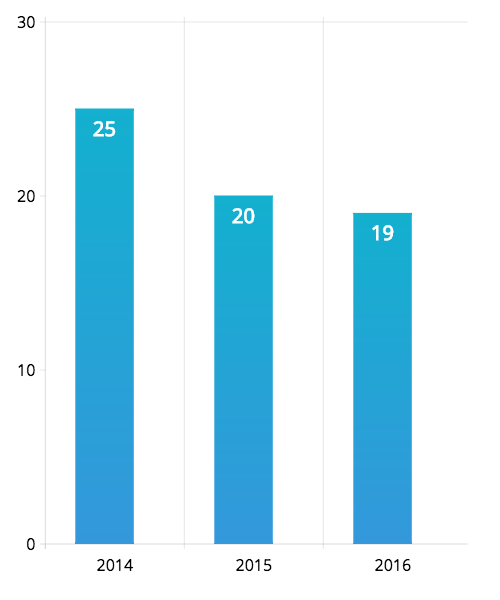

Nasdaq Dubai listed 16 Sukuk with a total nominal value of 11.45 billion US dollars during 2016, maintaining its position as the largest exchange in the world for Sukuk listings. Total current listed value rose to 43.9 billion US dollars by the end of the year, up from 34.1 billion US dollars at the end of 2015. Listings came from a variety of issuers ranging from multilateral lenders to publicly owned banks and companies in the transport, infrastructure and property sectors. Nasdaq Dubai is delighted to support their capital raising initiatives for the benefit of their business activities and their investors.

The first Sukuk listing of the year was a 500 million US dollar issuance by the multilateral Arab development bank APICORP, followed later in January by a listing from the Government of Sharjah also of 500 million US dollars. In March the Islamic Development Bank listed a 1.5 billion US dollar Sukuk, and the same month the government of Indonesia brought two Sukuk to the exchange valued at 750 million US dollar and 1.75 billion US dollars. Following its 2015 listings, this brought Indonesia’s total Sukuk listings on Nasdaq Dubai to 9 billion US dollars. Later in March Dubai Islamic Bank listed a 500 million US dollar Sukuk.

April brought the listing of a 300 million US dollar Sukuk by Islamic Corporation for the Development of the Private Sector, which raised the funds to provide financing and investment for private enterprise projects in its member countries. In May Nasdaq Dubai strengthened its links with Kuwait’s capital markets through a 250 million US dollar listing by Boubyan Bank. Three prominent UAE companies listed Sukuk in June – Emirates Islamic with a 750 million US dollar issuance, DP World with 1.2 billion US dollars and Noor Bank with 500 million US dollars.

Emirates Islamic returned to the market with another Sukuk listing of 250 million US dollars in September. Sharjah Islamic Bank listed a 500 million US dollar issuance the same month, followed by Emaar Properties with 750 million US dollars.

Kuwait’s Ahli United Bank listed a 200 million US dollar Sukuk in October and in December Islamic Bank listed its second Sukuk of the year of 1.25 billion US dollars, bringing the total Sukuk listings on the exchange issued by the Saudi-based multilateral lender to 8.55 billion US dollars.

As it further develops its Sukuk market, Nasdaq Dubai is committed to supporting the sector in a variety of ways apart from listings. In October the exchange announced a partnership with IdealRatings which launched benchmark indices that track the performance of global Sukuk, in order to provide investors with new data to make informed trading decisions. The data includes daily movements in price and total return, with monthly updates on yield and other key indicators, across a universe of more than 1,800 Sukuk.

Industrial and Commercial Bank of China (ICBC) listed the exchange’s first conventional bond of the year in June with a 400 million US dollar offering. It was the second bond that ICBC has brought to the exchange following a 500 million US dollar listing in 2015, underlining the growing financial relationship between Dubai and China. Majid Al Futaim listed a 300 million US dollar bond in July. Then in October China Construction Bank listed a 600 million US dollar bond, in the largest single debt listing so far on the exchange by a Chinese bank.

As part of the support that the exchange provides to its issuers, many of the Sukuk and bond listings during the year were marked by bell ceremonies at which senior representatives of issuers opened Nasdaq Dubai’s market. Attendees included His Excellency Essa Kazim, Governor of Dubai International Financial Centre (DIFC), Secretary General of DIEDC, Chairman of Borse Dubai and Dubai Financial Market (DFM) and a Board Director of Nasdaq Dubai, as well as Abdul Wahed Al Fahim, Chairman of Nasdaq Dubai, together with senior executives from Nasdaq Dubai, DFM and DIEDC.

The 7% rise in 2016 of the FTSE Nasdaq Dubai UAE 20 index reflected robust investor confidence in the UAE’s share markets in challenging global conditions. The index, which tracks 20 liquid stocks listed on Nasdaq Dubai, DFM and ADX, ended the year at 3,294. Traded value on Nasdaq Dubai was 1.24 billion US dollars, down 9% from 2015 in a year when some other regional exchanges experienced larger declines. Nasdaq Dubai continues to benefit from its diverse range of issuer companies and regional and international investor base. An example of this international reach came in February when the exchange announced a new share link facilitated by Misr for Central Clearing, Depository and Registry (MCDR) for Egyptian investors to trade on its market. This was followed by measures taken by the exchange to streamline the process for Egyptian brokers to connect to its market. In October, Beltone Market Maker announced it had begun making a market in shares of Egypt’s Orascom Construction, whose primary listing is on Nasdaq Dubai. Nasdaq Dubai and Amman Stock Exchange signed an MOU in December on cooperation possibilities, including dual listings of Jordanian companies.

Integrated Securities, a subsidiary of Abu Dhabi Financial Group, also became an equities Member during the year. The most active broker on the exchange by equities traded value in 2016 was EFG-Hermes, followed by Mubasher and Arqaam Securities.

Transactions on Nasdaq Dubai’s Murabaha platform for Islamic financing increased by 34% in 2016 to 24.0 billion USD dollars, up from 17.9 billion US dollars in 2015. The platform is used by banks and other financial institutions on behalf of individual as well as corporate clients. Established through a joint initiative with Emirates Islamic in 2014, the platform’s rapid growth reflects its ability to facilitate streamlined Sharia’a-compliant financing activities. It offers substantial advantages over traditional Murabaha channels, utilising Sharia’a-compliant Certificates that are traded in Nasdaq Dubai’s Central Securities Depository (CSD) and based on Wakala investments such as Sukuk. As well as providing Sharia’a certainty for individuals and institutions, the transactions can take place in minutes and are executed at a fixed price with no spread.

Nasdaq Dubai Academy delivered 38 training courses during the year, providing expert instruction in financial markets topics to more than 500 individuals, including employees of more than 50 companies. Topics ranged from Financial Communications Masterclass, Corporate Governance and Advanced Sukuk, to Islamic Trade Finance Products, Asset Liability Management, Islamic Asset Management Products and training for CISI’s Islamic Finance Qualification (IFQ) exam. Customised courses were offered to the broker community on topics such as Equity Futures, Anti-Money Laundering, Credit Risk Management and Capital Markets. The Academy also certified 9 individual brokers from 7 Member firms as Trading Managers able to trade on the exchange.

This section provides an overview of Nasdaq Dubai’s governance during the year 2016. It explains how the Company applies principles of sound corporate governance to ensure an environment of strategic direction, performance, accountability and control in the business.

At the foundation of a well governed company is an effective Board that provides good leadership and oversight, within a framework of prudent and effective controls that enable risk to be assessed and managed.

The Nasdaq Dubai Board is committed to the highest standards of corporate governance and business integrity.

The Nasdaq Dubai Board represents and acts on behalf of its shareholders, Dubai Financial Market and Borse Dubai, and is committed to strong corporate governance policies, practices and procedures designed to make the Board more effective in exercising its oversight role for achieving the Company’s strategic objectives and for the stewardship of the Company’s resources. The Board adopts the view that corporate governance should promote good performance and integrity as well as conformance with legislation and that effective governance practices enhance the Company’s ability to achieve its strategy and long-term success.

While the Board does not have responsibility for day to day management of the company, it stays informed about the company’s business and provides guidance to company management through periodic meetings and other interactions. In accordance with good governance practice, the roles of Chairman and Chief Executive are distinct and separate with a clear division of responsibilities. This separation of roles promotes more effective communication channels for the Board to express its views on Management. The Chairman presides over meetings and is responsible for the running and leadership of the Board and ensuring its effectiveness. The Chief Executive has delegated authority from and is responsible to the Board for managing the Company’s business. We believe that this separation of roles and allocation of distinct responsibilities to each role facilitates communication between senior management and the full Board about issues such as corporate governance, succession planning, executive compensation and company performance.

The Board has adopted a formal schedule of matters specifically reserved for its decision-making, which includes the annual budget, strategy and long term business objectives, major projects and contracts and significant capital expenditure. The Board has created three Committees to ensure effective and efficient Board operations in accordance with their respective Charters.

During the financial year, the Board met on 4 occasions in person in Dubai. The Board has continued to oversee the Group’s strategy, risk framework and financial performance. The Board uses Nasdaq’s online board portal, Directors Desk for its meetings that make the board process efficient and has the benefit of considerable savings in resources, paper and printing.

The Nasdaq Dubai Board comprises 7 Non-Executive Directors including the Chairman, Abdul Wahed Al Fahim. Biographical details of the Directors and the Committees on which they serve are set out below. The biographies demonstrate a wide range of experience and skills, including leadership and knowledge of corporate governance requirements and practices, enabling the Board members to discharge their responsibilities and to bring independent judgment on matters of strategy, performance and standards of conduct which are important to the success of the exchange.