Capital Admitted

No. Of Listings

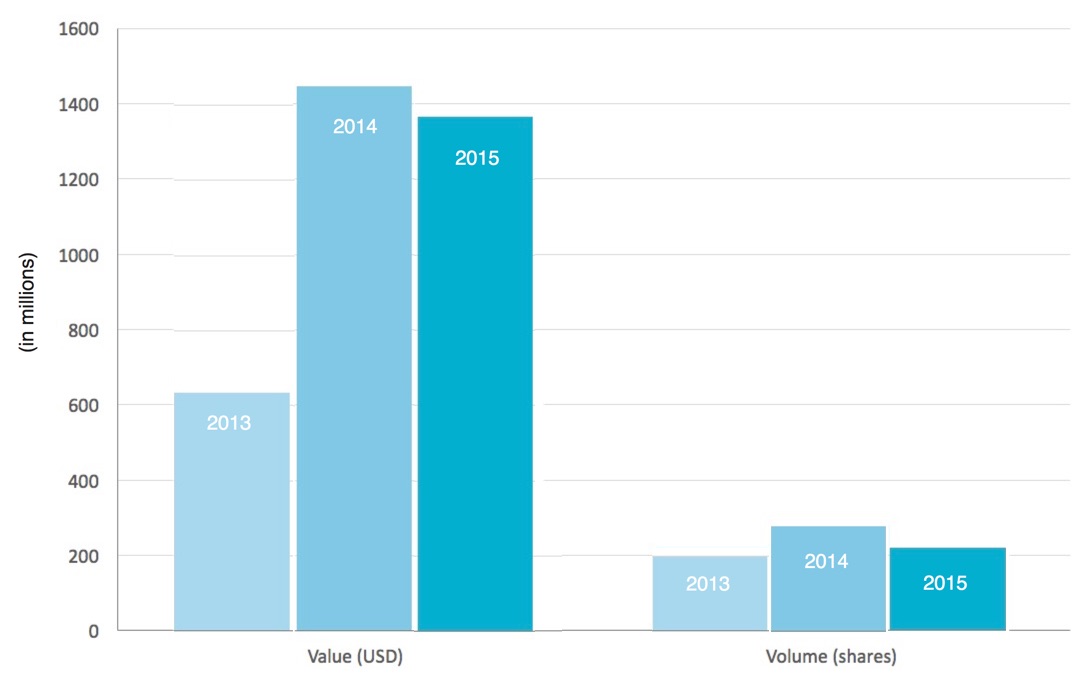

| Value (USD) | Volume (shares) | No. of trades | |

|---|---|---|---|

| 2015 | 1.368 billion | 219 million | 30,637 |

| 2014 | 1.447 billion | 280 million | 24,698 |

| 2013 | 633 million | 199 million | 11,910 |

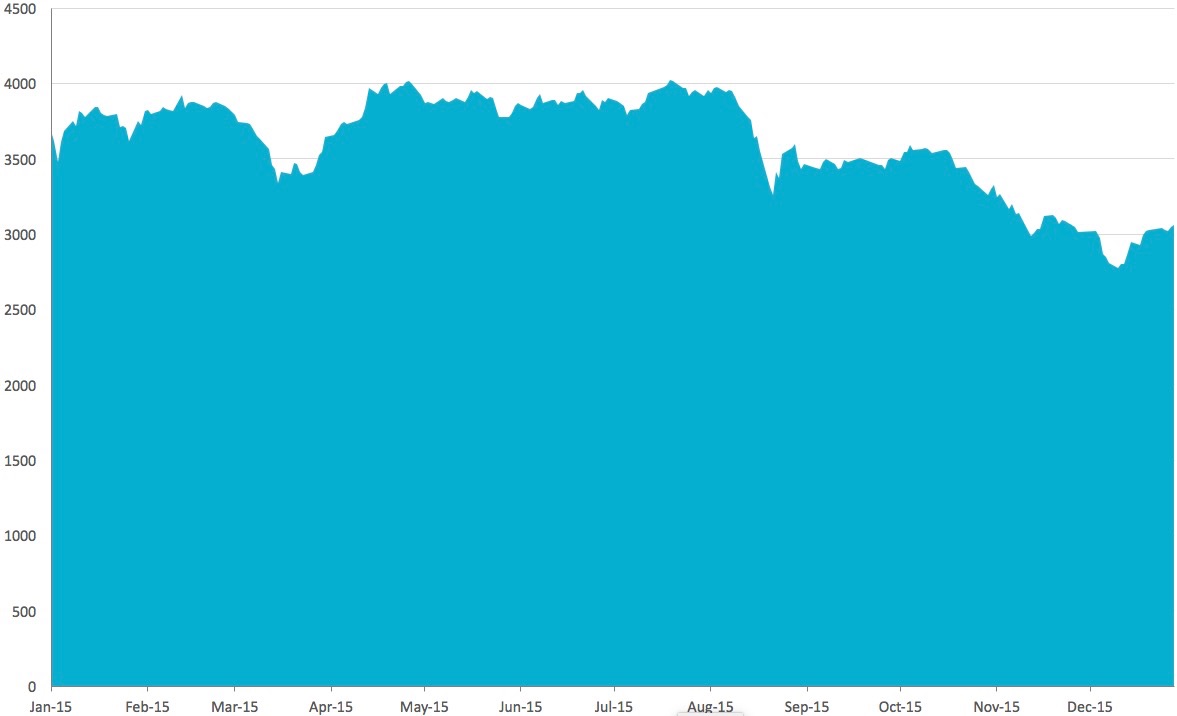

The index declined 19% over the year, from 3,776 at the end of 2014 to 3,063 at the end of 2015. It tracks 20 liquid stocks listed on DFM, the Abu Dhabi Securities Exchange and Nasdaq Dubai.

Most active 10 members by % traded value

| Member | % value |

|---|---|

| EFG Hermes | 51.26 |

| Mubasher Financial Services | 12.56 |

| Arqaam Securities | 12.31 |

| Deutsche Bank | 8.67 |

| Menacorp | 3.96 |

| Al Ramz | 3.88 |

| NBAD Securities | 2.5 |

| Emirates NBD Securities | 1.27 |

| Mashreq Securities | 0.99 |

| SHUAA Capital | 0.87 |

| Issuer | Month | Value (USD) |

|---|---|---|

| Orascom Construction | March | 1.54 billion |

| Issuer | Month | Value (USD) |

|---|---|---|

| DIB Sukuk | January | 1 billion |

| IDB Trust Services | March | 1 billion |

| RAK Capital | April | 1 billion |

| Khadrawy (Emirates) | April | 913 million |

| SIB Sukuk | April | 500 million |

| Noor Sukuk | April | 500 million |

| Government of Indonesia | May | 1 billion |

| Government of Indonesia | May | 1.5 billion |

| Government of Indonesia | May | 1.5 billion |

| Government of Indonesia | May | 2 billion |

| Government of Hong Kong | June | 1 billion |

| DIB Sukuk | June | 750 million |

| IFC Sukuk | September | 100 million |

| MAF Sukuk | November | 500 million |

| Total | 13.26 billion |

| Issuer | Month | Value (USD) |

|---|---|---|

| Emirates NBD | March | 601 million |

| Emirates NBD | May | 350 million |

| ICBC | May | 500 million |

| DP World | May | 500 million |

| Bank of China | July | 322 million |

| Total | 2.27 billion |

Abdul Wahed Al Fahim

Chairman, Nasdaq Dubai

The wisdom of Dubai’s commitment to developing world class capital markets has become clearer than ever. From establishing itself as the world’s leading Sukuk listing centre, to securing a major international equity listing, Dubai made great strides in 2015 that position it for further growth as the region’s financial sector hub. This strategy plays a key role in the Emirate’s drive to diversify its economy across numerous industries, as it prepares for changing global conditions in which technical sophistication and international relationships will be key to national prosperity.

The continued growth of Nasdaq Dubai is not only about the volume of its listings and traded value. Its overarching mission is to create new, advanced markets that will fuel the region’s economic growth and provide new investment opportunities for institutions and individuals. We made great progress in 2015 and look forward to further significant developments in the coming year.

by

Hamed Ali

Chief Executive Officer, Nasdaq Dubai

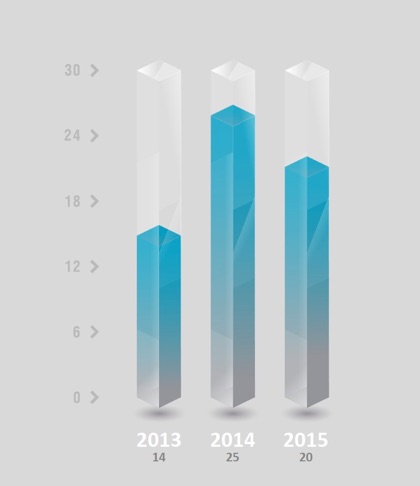

During 2015 the exchange attracted 20 listings, from Hong Kong to Indonesia and Egypt, showing the true coverage of Nasdaq Dubai as an international market serving the region and beyond. We are pleased with this progress. The listing of Orascom Construction shares with a market capitalisation of USD 1.54 billion strengthens our focus on Egypt as a key market. The exchange took practical steps to facilitate share fungibility between Dubai and Cairo well before the Orascom listing took place.

Another highlight was the achievement of becoming the world’s largest exchange for Sukuk by value, as reported with great interest by the international media in July. We ended the year with a total Sukuk value of 34.1 billion US dollars, putting Dubai ahead of every other centre in the world. This was a goal we had targeted for a long time, even before the Dubai government’s initiative, announced in February 2013, to become the global centre for Sukuk activity.

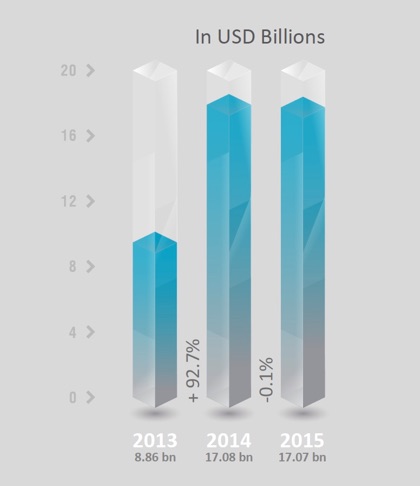

Listing activity remained strong in 2015 in terms of the total value of securities admitted to the exchange, at USD 16.75 billion. This broadly maintained the improvement achieved in 2014, when the pace of new listings increased significantly over the year before. Our success in attracting issuers results from another initiative that we launched several years ago, which was to raise our visibility both regionally and internationally, including in East Asia. This strategy has enabled us to admit many securities that traditionally would not have found a home on a Middle East exchange.

The listing in March of Orascom Construction, one of Egypt’s and the region’s most prominent companies, was a groundbreaking event for the Middle East’s capital markets. For the first time, a major regional company from outside the GCC chose Nasdaq Dubai for its primary listing, benefiting from the exchange’s international investor links, global profile and world class regulation. With a market capitalisation of 1.54 billion US dollars on listing day, trading in the company’s shares in the first week averaged more than 13 million US dollars a day.

Equities traded value of all shares on the exchange in 2015 totalled 1.368 billion US dollars, comparable to 1.447 billion US dollars in 2014, and well ahead of 633 million US dollars in 2013. In a challenging year for the UAE’s equity markets, the 2015 value reflected the exchange’s growing public profile and excellent links to market participants.

Three brokerages joined Nasdaq Dubai’s market during the year as International Clearing Members (ICM) for equities, in order to benefit from expected trading growth and new investment opportunities. UAE brokers SHUAA Securities and Mawarid Securities have full ICM equities capacity, while Cairo-based Beltone Market Maker joined specifically to make markets in equities, becoming the first Egyptian entity to provide such a service on the exchange. Their arrival raises the number of Members on Nasdaq Dubai to 36.

Nasdaq Dubai listed 14 Sukuk with a total nominal value of 13.26 billion US dollars during 2015, which is more than the value that listed on the next three largest exchanges in the world combined.This dominance has led to the exchange becoming the largest globally for currently listed Sukuk at 34.1 US dollars, and Dubai as a whole becoming the largest Sukuk listing centre at 36.8 billion US dollars.

A market-opening bell ringing event held in January for flydubai’s 500 million US dollar Sukuk, which listed at the end of 2014, was followed by the listing the same month of a 1 billion US dollar Sukuk by Dubai Islamic Bank. In March, Islamic Development Bank also listed a 1 billion US dollar Sukuk, bringing the total current Sukuk listings on the exchange issued by the Saudi-based multilateral lender to 5.05 billion US dollars.

April brought four Sukuk listings from UAE issuers, reflecting the increasing popularity of the asset class as a vehicle for local enterprises to fund their expansion. RAK Capital and Emirates Airline listed Sukuk valued at 1 billion US dollars and 913 million US dollars respectively, while Sharjah Islamic Bank and Noor Bank listed securities valued at 500 million dollars each.

In May, the government of Indonesia carried out one of the most significant debt listing programmes ever conducted on any exchange, listing four Sukuk valued at 6 billion US dollars. This decision by the world’s most populous Muslim nation represents a landmark in Dubai’s global outreach strategy in Islamic finance, under the initiative for the Emirate to become the capital of the Islamic Economy globally announced in 2013 by His Highness Sheikh Mohammed Bin Rashid Al Maktoum, UAE Vice President and Prime Minster, and Ruler of Dubai.

Nasdaq Dubai’s growing profile in East Asia was raised further in June with the listing of a 1 billion US dollar Sukuk by the government of Hong Kong, following the listing of its inaugural Sukuk on the exchange in 2014. Dubai Islamic Bank then listed its second Sukuk of the year in June, a 750 million US dollar offering. IFC, part of the World Bank, brought a 100 million US dollar Sukuk to the exchange in September. This was its second Sukuk listing, after it brought its inaugural Sukuk to Nasdaq Dubai in 2009. In the final listing of the year, Majid Al Futaim listed a 500 million US dollar Sukuk in November.

Emirates NBD listed two conventional bonds in March and May, of 550 million euros (601 million US dollars) and 350 million US dollars respectively. This brought the total currently listed debt issued by Emirates NBD Group entities on the exchange to 5.99 billion US dollars, a larger amount than any other UAE enterprise. In May, Industrial and Commercial Bank of China, the world’s largest bank by assets, become the third Chinese bank ever to list a conventional bond on the exchange, at 500 million US dollars. DP World, the exchange’s largest equity issuer by market capitalisation, listed a 500 million US dollar conventional bond in June. Then Bank of China listed a two billion renminbi (322 million US dollar) conventional bond in July to support China’s ‘one belt, one road’ international economic initiative.

Many of the year’s debt listings were marked by bell-ringing ceremonies at which senior representatives of issuer companies opened Nasdaq Dubai’s market. Dubai attendees included His Excellency Mohammed Abdulla Al Gergawi, UAE Cabinet Affairs Minister and Chairman of the Board, Dubai Islamic Economy Development Centre (DIEDC), as well as His Excellency Essa Kazim, Governor of Dubai International Financial Centre (DIFC), Secretary General of DIEDC, Chairman of Dubai Financial Market (DFM) and a Board Director of Nasdaq Dubai. Abdul Wahed Al Fahim, Chairman of Nasdaq Dubai, also attended together with senior executives from Nasdaq Dubai, DFM and DIEDC.

Transactions on Nasdaq Dubai’s Murabaha platform for Islamic financing increased by 125% in 2015, rising to AED 65.8 billion from AED 29.3 billion in 2014. The success of the platform led to it winning the prestigious Euromoney Award for Innovation in Islamic Finance in May 2015. The following month Ajman Bank began transacting on the platform, which was developed by Nasdaq Dubai together with EI and is used extensively by a number of institutions to facilitate streamlined Sharia’a-compliant financing activities. The platform offers significant advantages over alternative Murabaha channels, utilising Sharia’a-compliant Certificates that are traded in Nasdaq Dubai’s Central Securities Depository (CSD) and based on Wakala investments such as Sukuk. As well as providing Sharia’a certainty for individuals and institutions, the transactions can take place in minutes and are executed at a fixed price with no spread.

Nasdaq Dubai Academy delivered 26 training courses during the year, lasting between one day and two months, as it diversified its educational outreach with the aim of raising capital markets knowledge and standards in the region. Topics ranged from courses for CFA’s Claritas Investment Certificate and CISI’s Islamic Finance Qualification (IFQ), to Islamic treasury and risk management, Sharia’a compliance, equity futures, anti-money laundering, corporate governance and other financial subjects. Expert training partners of the Academy included REDmoney, Genesis Institute and HumanPro. The Academy also certified 9 individual brokers from 6 Member firms as Trading Managers able to trade on the exchange.

The international expansion that drove much of our activity in 2015 has many facets. As well as our listings from around the region and the world, we have strengthened our overseas relationships in a variety of other ways. For example I was delighted, in my capacity as Nasdaq Dubai’s CEO, to become a Board Director of Bahrain-based International Islamic Financial Market (IIFM), the Islamic financial services industry’s standardisation organisation. The exchange also signed a Memorandum of Understanding with Kazakhstan Stock Exchange to explore collaboration possibilities.

Our international focus will increase in 2016, including an emphasis on regional and international debt listings as well as equity opportunities. In line with our commitment to bringing innovation to the region’s capital markets, we are also preparing further initiatives in equity derivatives as well as other activities.

This section provides an overview of Nasdaq Dubai’s governance during the year 2015. It explains how the Company applies principles of sound corporate governance to ensure an environment of strategic direction, performance, accountability and control in the business.

At the foundation of a well governed company is an effective Board that provides good leadership and oversight, within a framework of prudent and effective controls that enable risk to be assessed and managed.

The Nasdaq Dubai Board is committed to the highest standards of corporate governance and business integrity.

The Nasdaq Dubai Board represents and acts on behalf of its shareholders, Dubai Financial Market and Borse Dubai, and is committed to strong corporate governance policies, practices and procedures designed to make the Board more effective in exercising its oversight role for achieving the Company’s strategic objectives and for the stewardship of the Company’s resources. The Board adopts the view that corporate governance should promote good performance and integrity as well as conformance with legislation and that effective governance practices enhance the Company’s ability to achieve its strategy and long-term success.

While the Board does not have responsibility for day to day management of the company, it stays informed about the company’s business and provides guidance to company management through periodic meetings and other interactions. In accordance with good governance practice, the roles of Chairman and Chief Executive are distinct and separate with a clear division of responsibilities. This separation of roles promotes more effective communication channels for the Board to express its views on Management. The Chairman presides over meetings and is responsible for the running and leadership of the Board and ensuring its effectiveness. The Chief Executive has delegated authority from and is responsible to the Board for managing the Company’s business. We believe that this separation of roles and allocation of distinct responsibilities to each role facilitates communication between senior management and the full Board about issues such as corporate governance, succession planning, executive compensation and company performance.

The Board has adopted a formal schedule of matters specifically reserved for its decision-making, which includes the annual budget, strategy and long term business objectives, major projects and contracts and significant capital expenditure. The Board has created three Committees to ensure effective and efficient Board operations in accordance with their respective Charters.

During the financial year, the Board met on 4 occasions in person in Dubai. The Board has continued to oversee the Group’s strategy, risk framework and financial performance. The Board has electronic meetings through the use of iPad and Nasdaq’s online board portal, Directors Desk. In addition to making the board process more efficient, this has had the benefit of considerable savings in resources, paper and printing.

The Nasdaq Dubai Board comprises 7 Non-Executive Directors including the Chairman, Abdul Wahed Al Fahim. Biographical details of the Directors and the Committees on which they serve are set out below. The biographies demonstrate a wide range of experience and skills, including leadership and knowledge of corporate governance requirements and practices, enabling the Board members to discharge their responsibilities and to bring independent judgment on matters of strategy, performance and standards of conduct which are important to the success of the exchange.