Equities Traded

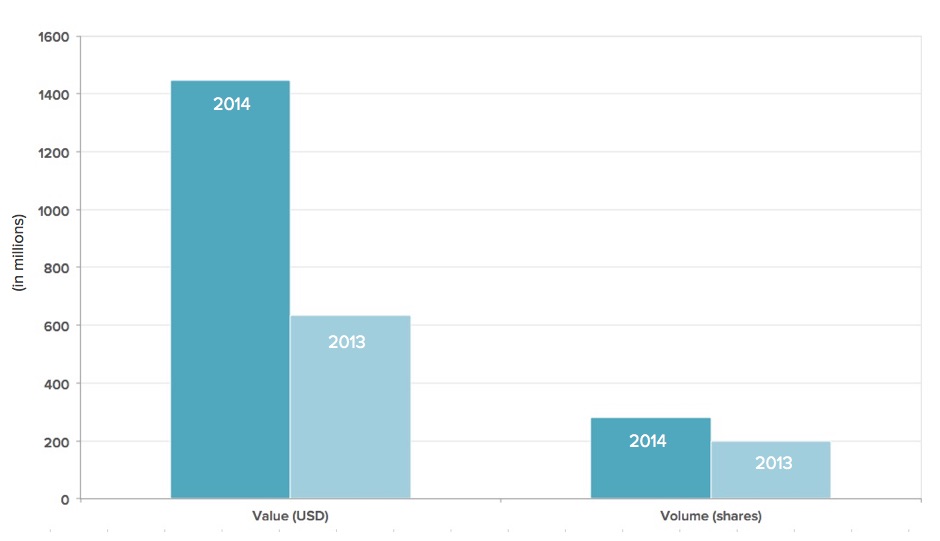

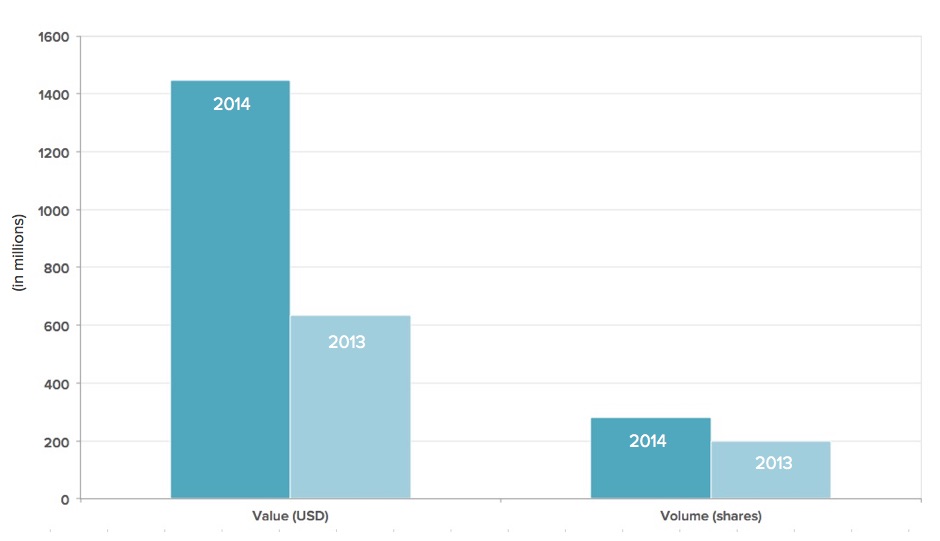

| Value ($) | Volume (shares) | No. of trades | |

|---|---|---|---|

| 2014 | 1.447 billion | 280 million | 24,698 |

| 2013 | 633 million | 199 million | 11,910 |

| Value ($) | Volume (shares) | No. of trades | |

|---|---|---|---|

| 2014 | 1.447 billion | 280 million | 24,698 |

| 2013 | 633 million | 199 million | 11,910 |

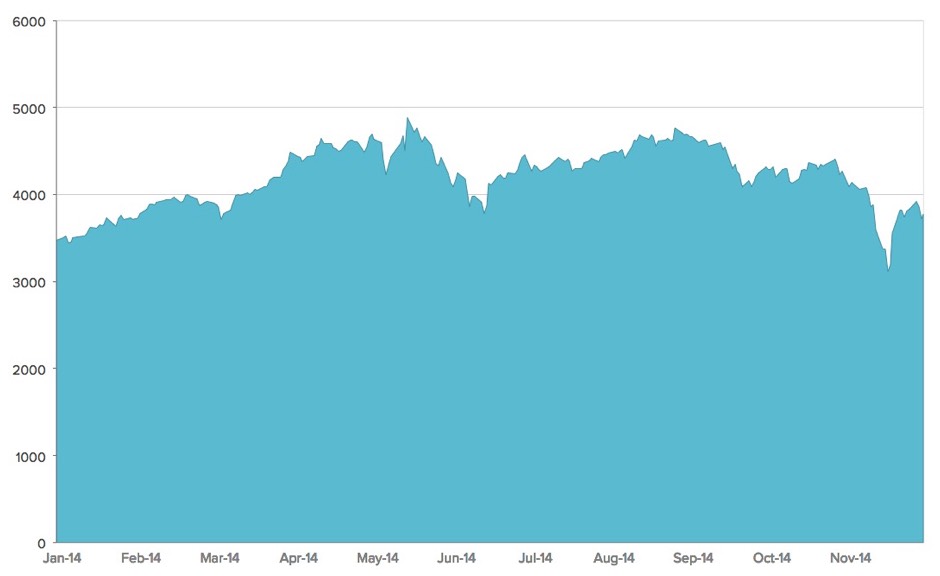

The index rose 11% over the year, from 3,397 at the end of 2013 to 3,766 at the end of 2014. It tracks 20 liquid stocks listed on DFM, the Abu Dhabi Securities Exchange and NASDAQ Dubai.

Most active 10 members by % traded value

| Member | % value |

|---|---|

| EFG-Hermes Brokerage | 36.09 |

| Mubasher Financial Services | 21.53 |

| Arqaam Securities | 14.73 |

| Deutsche Bank | 12.19 |

| Al Ramz | 4.81 |

| Mashreq Securities | 4.31 |

| MENA Corp Financial Services | 2.26 |

| Emirates NBD Securities | 1.92 |

| National Bank of Abu Dhabi | 1.25 |

| Al Dhabi Brokerage | 0.43 |

| Issuer | Month | Value (USD) |

|---|---|---|

| Emirates REIT | April | 201 million |

| Issuer | Month | Value (USD) |

|---|---|---|

| DIP Sukuk | February | 300 million |

| IDB Trust Services | February | 500 million |

| IDB Trust Services | February | 750 million |

| IDB Trust Services | February | 800 million |

| IDB Trust Services | February | 850 million |

| IDB Trust Services | February | 1 billion |

| IDB Trust Services | March | 1.5 billion |

| Alpha Star Holding | April | 650 million |

| ICD Sukuk Company | May | 700 million |

| Dar Al-Arkan Sukuk Company | May | 450 million |

| Dar Al-Arkan Sukuk Company | May | 400 million |

| Dar Al-Arkan Sukuk Company | May | 300 million |

| EMG Sukuk | June | 750 million |

| Sharjah Sukuk | September | 750 million |

| Hong Kong Sukuk | September | 1 billion |

| IDB Trust Services | September | 1.5 billion |

| DIFC Sukuk | November | 700 million |

| Al Shindagha Sukuk | November | 500 million |

| Total | 13.4 billion |

| Issuer | Month | Value (USD) |

|---|---|---|

| MAF Global Securities | May | 500 million |

| ICD Funding | May | 300 million |

| Agricultural Bank of China | September | 162.9 million |

| Emirates NBD 2014 Tier 1 | September | 500 million |

| Emirates NBD | October | 79.5 million |

| Emirates NBD | November | 1 billion |

| Total | 2.54 billion |

Abdul Wahed Al Fahim

Chairman, NASDAQ Dubai

Dubai’s capital markets are going from strength to strength, in tandem with the growth of its economy. Just as Dubai’s wider business environment is expanding in sophistication and innovation, as well as size, so the Emirate’s exchange infrastructure and activities are also making rapid progress. NASDAQ Dubai, with its commitment to combining international with regional know-how and connections, lies at the heart of this process.

In 2014, the exchange focused successfully on integrating itself more deeply into the global capital markets framework, welcoming many new business connections and moving closer to its goal of becoming one of the world’s great international stock markets. At the same time, NASDAQ Dubai expanded its UAE and regional links. Overall it was the most active year for the exchange since it was founded in 2005. Even greater opportunities lie ahead.

by

Hamed Ali

Chief Executive Officer, NASDAQ Dubai

In a dynamic year for the UAE’s capital markets in 2014, NASDAQ Dubai attracted many new listings and strengthened its leadership role in innovation. The exchange’s global reach was underlined by two ground-breaking debt listings from China. Islamic finance was a particular focus, including the rapid growth of the exchange’s Sukuk market and the official launch of its Murabaha platform. Supported by MSCI’s upgrade of the UAE to Emerging Market status, traded equities value on NASDAQ Dubai more than doubled from 2013. The exchange also welcomed the IPO of the first Real Estate Investment Trust (REIT) ever to list in the GCC.

NASDAQ Dubai spearheaded Dubai’s expansion as a leading global centre for Sukuk activity and expertise throughout 2014, through the listing of 18 Sukuk with a total nominal value of 13.4 billion US dollars. At the end of the year the exchange’s nominal Sukuk value stood at 21.3 billion US dollars, one of the largest totals in the world. Streamlined listing procedures and NASDAQ Dubai’s ability to project visibility to a global investor base brought in listings from a diverse range of sovereign and corporate issuers that are active in a broad spectrum of industry sectors, from the region and beyond. As well as supporting the capital raising need of each issuer, the exchange is delighted to be playing a role in the growth of Islamic finance to new participants internationally, beyond the sector’s traditional constituencies.

A 300 million US dollar listing by Dubai Investments Park in February was followed the same month by the listing of five Sukuk totaling 3.9 billion dollars by the Islamic Development Bank (IDB). In March the IDB, headquartered in Jeddah and owned by 59 countries, listed a sixth Sukuk valued at 1.5 billion US dollars. In April the Dubai-based property company DAMAC listed its 650 million US dollar Alpha Star Holding Sukuk. The Investment Corporation of Dubai (ICD) listed a 700 million dollar Sukuk in May and the same month the Saudi Arabian property company Dar Al-Arkan listed three Sukuk with a total value of 1.15 billion US dollars. Emaar Malls Group listed a 750 million US dollar Sukuk in June.

In September the Emirate of Sharjah listed a 750 million US dollar Sukuk and the same month the exchange attracted the first ever Sukuk to be issued by the government of Hong Kong, at one billion US dollars. The IDB listed its seventh Sukuk later in the month valued at 1.5 billion dollars. DIFC Investments, the investment arm of the Dubai International Finance Centre in which NASDAQ Dubai is located, listed a 700 million US dollar Sukuk in November and the same month the airline flydubai listed its 500 million US dollar Al Shindagha Sukuk.

Issuers of conventional bonds also made good use of NASDAQ Dubai’s platform during the year. Dubai-based conglomerate Majid Al Futtaim listed a 500 million US dollar bond in May and ICD listed a 300 million US dollar issuance in the same month. Agricultural Bank of China, China’s third largest bank by assets, listed a one billion renminbi (162.9 million US dollar) bond in September, in the first ever debt listing by a Chinese issuer on an exchange in the MENA region. Emirates NBD bank listed a 500 million US dollar Sukuk in September and the following month listed a 100 million New Zealand dollar (79.5 million US dollar) bond. In November the bank listed a third bond valued at one billion US dollars.

Many of the year’s listings were marked by bell-ringing ceremonies at which senior representatives of issuer companies opened the market. Underlining the significance of these occasions for the UAE’s capital markets, senior attendees included His Excellency Mohammed Abdulla Al Gergawi, Chairman of the Executive Office of His Highness Sheikh Mohammed Bin Rashid Al Maktoum and Chairman of the Board, Dubai Islamic Economy Development Centre (DIEDC), as well as His Excellency Essa Kazim, who is Governor of Dubai International Financial Centre (DIFC), Secretary General of DIEDC, Chairman of Dubai Financial Market (DFM) and a Board Director of NASDAQ Dubai. Abdul Wahed Al Fahim, Chairman of NASDAQ Dubai, also attended together with senior executives from NASDAQ Dubai, DFM and DIEDC.

NASDAQ Dubai’s innovative Murabaha platform for Islamic financing was officially launched in April 2014 by His Highness Sheikh Hamdan bin Mohammed bin Rashid Al Maktoum, Crown Prince of Dubai and the patron of the initiative to make Dubai the global capital of the Islamic Economy. As well as providing Sharia’a certainty for individuals and institutions, the streamlined transactions in certificates on the platform can take place in minutes and are executed at a fixed price with no spread - thus eliminating the delays, poor liquidity and price risks that can affect other financing solutions such as commodity transactions. After being set up in collaboration with Emirates Islamic in a pilot scheme in 2013, the platform grew substantially during 2014, with both Sharjah Islamic Bank and Aafaq – Islamic Finance linking to it and facilitating transactions by their clients.

By allowing the use of various Sharia-compliant asset classes as the underlying for transactions, the platform offers great flexibility to financial institutions. By the end of 2014 more than AED 21 billion of transactions had taken place on it, demonstrating its potential to attract further UAE and regional clients and make Dubai the international centre for processing Sharia’a-compliant financing.

Following an active year of equities trading the FTSE NASDAQ Dubai UAE 20 index ended 2014 at 3,766, 11% higher than at end-2013. This robust performance was supported by the well deserved promotion of the country by MSCI to Emerging Markets status in June 2014. As well as bringing newly mandated funds into UAE shares – including DP World, NASDAQ Dubai’s largest listed company – MSCI’s decision has contributed to the increasingly positive international and regional investor sentiment towards the UAE share markets. Equities traded value on NASDAQ Dubai totaled USD 1.45 billion in 2014, a 129% increase over USD 633 million in 2013.

In April the exchange welcomed the USD 201 million listing of Emirates REIT. As well as being the first IPO in Dubai for more than five years, this was the first listing of a Real Estate Investment Trust on an exchange in the GCC. NASDAQ Dubai is delighted to have been able to introduce this new asset class to the region’s investors.

In the same month Jafza, the free zone in Jebel Ali, announced that following changes to its business framework, the more than 7,000 companies registered there may apply to list directly on the exchange. The exchange’s focus on attracting regional equity listings was underlined in November by the signing of an agreement with Misr for Central Clearing, Depository and Registry (MCDR) to establish technical links, with a view to facilitating dual listings for companies on both NASDAQ Dubai and the Egyptian Exchange.

In order to benefit from expected growth in NASDAQ Dubai’s equity market, three brokers - Arqaam Capital, ADIB Securities, and Brokerage House Securities - became equities Members of NASDAQ Dubai during the year.

NASDAQ Dubai Academy expanded its educational mission during 2014, providing 17 high quality training courses for the financial services community and other participants. These included three two-month courses for CFA’s new international benchmark qualification, the Claritas Investment Certificate. Corporate governance, money laundering and compliance were among other topics covered in one- and two-day courses, as well as derivatives, credit risk, investor relations communications, and Sukuk securitisation. Training partners of the Academy included Alternative International Management Services, Finance Talking, Fitch Learning, Genesis Institute, Redmoney, and Thomson Reuters. The Academy also certified 7 individual brokers from 7 Member firms as Trading Managers able to trade on the exchange.

This section provides an overview of NASDAQ Dubai’s governance during the year 2014. It explains how the Company applies principles of sound corporate governance to ensure an environment of strategic direction, performance, accountability and control in the business.

At the foundation of a well governed company is an effective Board that provides good leadership and oversight, within a framework of prudent and effective controls that enable risk to be assessed and managed. The NASDAQ Dubai Board is committed to the highest standards of corporate governance and business integrity.

The NASDAQ Dubai Board is responsible to its shareholders, Dubai Financial Market and Borse Dubai, for achieving the Company’s strategic objectives and for the stewardship of the Company’s resources. The Board adopts the view that corporate governance should promote good performance and integrity as well as conformance with legislation and that effective governance practices enhance the Company’s ability to achieve its strategy and long-term success.

The Board determines the policies and practices which govern the operation and management of NASDAQ Dubai and has the responsibility to ensure that the Company achieves its key objectives.

In accordance with good governance practice, the roles of Chairman and Chief Executive are distinct and separate with a clear division of responsibilities. The Chairman is responsible for the running and leadership of the Board and ensuring its effectiveness. The Chief Executive has delegated authority from, and is responsible to, the Board for managing the Company’s business.

The Board has adopted a formal schedule of matters specifically reserved for its decision-making, which includes the annual budget, strategy and long term business objectives, major projects and contracts and significant capital expenditure. Certain matters are delegated to the three Committees of the Board in accordance with their respective Charters.

During the financial year, the Board met on 4 occasions in person in Dubai. The Board has continued to oversee the Group’s strategy, risk framework and financial performance. The Board has electronic meetings through the use of iPad and Nasdaq's online board portal, Directors Desk. In addition to making the board process more efficient, this has had the benefit of considerable savings in resources, paper and printing.

The NASDAQ Dubai Board comprises 7 Non-Executive Directors including the Chairman, Abdul Wahed Al Fahim. Biographical details of the Directors and the Committees on which they serve are set out below. The biographies demonstrate a wide range of experience and skills enabling the Board members to discharge their responsibilities and to bring independent judgment on matters of strategy, performance and standards of conduct which are important to the success of the exchange.